IQ Backoffice – A Full Service Provider of Accounting Services for the Restaurant Industry

IQ BackOffice is a leading accounting outsourcer, offering complete back office accounting services to restaurant and hospitality companies worldwide. Through our process reviews, process reengineering and web‐enabled systems, our clients see systemic improvements that include fewer errors, lower costs, faster access to data, stronger controls and more informed decision making.

Save up to 68% while improving quality and internal controls

IQ BackOffice recognizes the unique challenges facing the restaurant and hospitality industries, including receiving invoices at many geographically diverse locations, payrolls with high turnover, large amounts of cash, credit card payments and numerous fixed assets.

Our solutions start with detailed reviews of your processes and procedures. We leverage your existing accounting systems and other back office infrastructure instead of replacing them, reducing implementation timeframes, risk and expense, as well as allowing all of your existing interfaces, reports and tools to function as they do today. Our goal is to develop a Client-‐ Centric solution that meets your unique requirements.

Our proprietary Archimedes software helps you manage your accounting processes from any web-‐enabled device, and our experienced team of implementation and processing experts will ensure you have the right tools to succeed.

Through our partnerships with electronic payment solution providers, IQ BackOffice can help make even the most established processes more efficient and turn your accounting costs into real savings.

IQ BackOffice is proud to offer a full suite of outsourced accounting services, including:

- Financial Statement Preparation

- Accounts Payable

- Payroll Services

- Daily Deposit Verification

- Fixed Asset Reporting

- Cash and Credit Card Reconciliation

- Electronic Payment Solutions

- Virtual Credit Card Rebates

Financial Statement Preparation

IQ BackOffice provides timely, accurate monthly financial statement reporting. This includes income statements, balance sheets and cash flow statements.

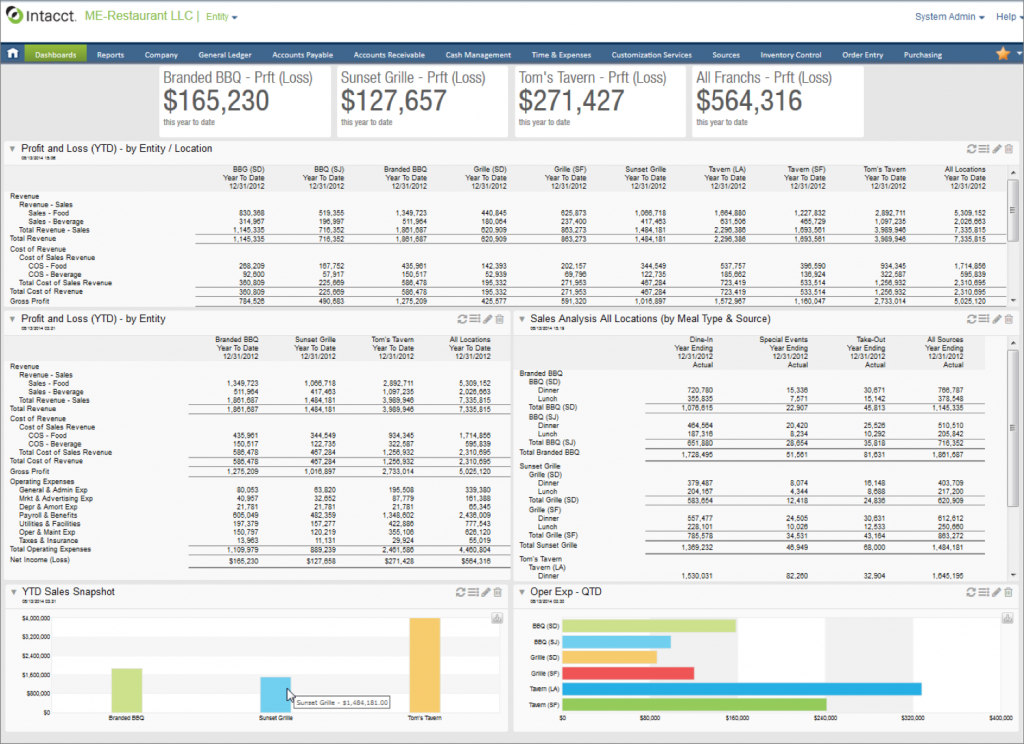

We can deliver this reporting via our state of the art web-based accounting platform Intacct or utilize your existing accounting platform to provide complete visibility into all of your financial metrics.

Intaact Financial Dashboard

Accounts Payable Services

Per dollar of revenue, the restaurant and hospitality industry has the highest accounts payable processing costs, due to both the number of invoices received and their level of detail. Other invoicing challenges your industry faces include:

- Data entry error rates that range from 5% to 10%.

- Duplicate Invoices that can range from 3% to 4%.

- 25% to 33% of food and beverage invoices have credits.

- Paper invoices that get lost on desks or in transit.

- Lack of audit trails makes transaction status hard to track.

IQ BackOffice’s service offerings are based on a procure-to-payment approach that incorporates every element of your accounts payable process, from invoice receipt to payments.

IQ BackOffice starts by re‐engineering your accounts payable process into a best practices solution that we encode into our proprietary Archimedes software. Archimedes ensures proper coding and guides invoices through the approval process.

Then we work with your vendors to send electronic invoices to Archimedes and paper invoices to a client‐dedicated mailbox. IQ BackOffice scans the invoices into Archimedes and archives the paper copies.

At our Shared Service Centers, IQ staff review, code and match your invoices, note exceptions, and route them for online approval. You will have full control of your invoices, along with 24/7 phone and email support in a SSAE 18/SAS 70 Type II certified environment.

Payroll Services

High turnover and part-time or seasonal staff make payroll processing difficult for the restaurant and hospitality industry. IQ BackOffice is ready with the tools and technology to help:

- Reduce costs

- Keep up on payroll rules and regulations

- Handle new hires and terminations

- Send accurate, timely data to your payroll provider

- Coordinate paycheck deliveries

- Pay via direct deposit and electronic debit cards

- Answer employee’s questions

- Deal with any payroll errors or problems

- Image all payroll transactions

- Electronically route transactions for approval

Our experience with leading payroll processors and systems will ensure you get the most out of your investments. Together with your payroll provider, IQ BackOffice will provide a state‐of-the‐art solution that will address all your requirements.

Daily Deposit Verification

IQ BackOffice will match and verify cash, credit cards and gift card purchases with bank deposits on a daily basis. We will identify any issue and report them to your senior management before they escalate into a more serious issue.

Cash and Credit Card Reconciliation

IQ BackOffice will complete bank reconciliations on a real time basis. This will allow us to complete your monthly financial statement on a more timely basis.

Fixed Asset Reporting

IQ BackOffice will manage your fixed asset reporting on a real-time basis. You can be assured your fixed asset depreciation reporting will be updated and current.

Disbursement Solutions

IQ BackOffice works with standard-setting electronic payment solution partners to provide a fully integrated, bank neutral platform. When an invoice is approved, IQ BackOffice forwards the data into your ERP system for payment processing. From there, the payment file is sent to a partner provider who issues a check or electronic (ACH or credit card) payment.

Credit Card Rebates

IQ BackOffice offers an accounts payable credit card payment solution, a secure solution that streamlines your accounts payable payment process while turning your accounts payable department into a revenue generator.

Our partners electronically generate a unique virtual credit card account number for every vendor payable, creating a secure alternative to manual checks. These numbers are delivered to suppliers via an associated remittance advice.

Vendors process virtual accounts as they would any other credit card. The advantages of a virtual credit card include:

- No setup fee or minimum spend

- Convenience and worldwide acceptance

- Automatic reconciliation

- Payment expiration and amount limits reduce fraud

- Detailed remittance advice

- Streamlined payment processes

- Reduced manual disbursement costs

In addition to the benefits listed above, our vendor partner offers a monthly rebate of up to 1.5% on all settlement volume. The speed and convenience of paying electronically can also help your company take advantage of vendor rapid-pay discounts.

IQ BackOffice Value Proposition

- Client-centric approach

- Formalize your processes

- Eliminates up to 68% of costs

- SAS 70/SSAE 18 Type II certification

- 24/7 user and vendor support via phone and email

- 24-‐hour transaction processing

- All transactions routed electronically

- Real-time audit trails for each transaction

- Web-‐based technology accessible virtually anywhere

- 99.97% per-‐transaction accuracy rating

- Automatic error and duplicate invoice detection; IQ has caught over $3 Billion dollars in duplicate invoices.

- More than 150 years of management experience

- Annually processes more than 2.5 million transactions, worth a total of $15 billion

For more information, contact:

Ken Johnson

(310) 322-2311

extension 1017

ken@iqbackoffice.com

2121 Rosecrans Avenue, Suite 3350

El Segundo, CA 90245

www.iqbackoffice.com