Introduction

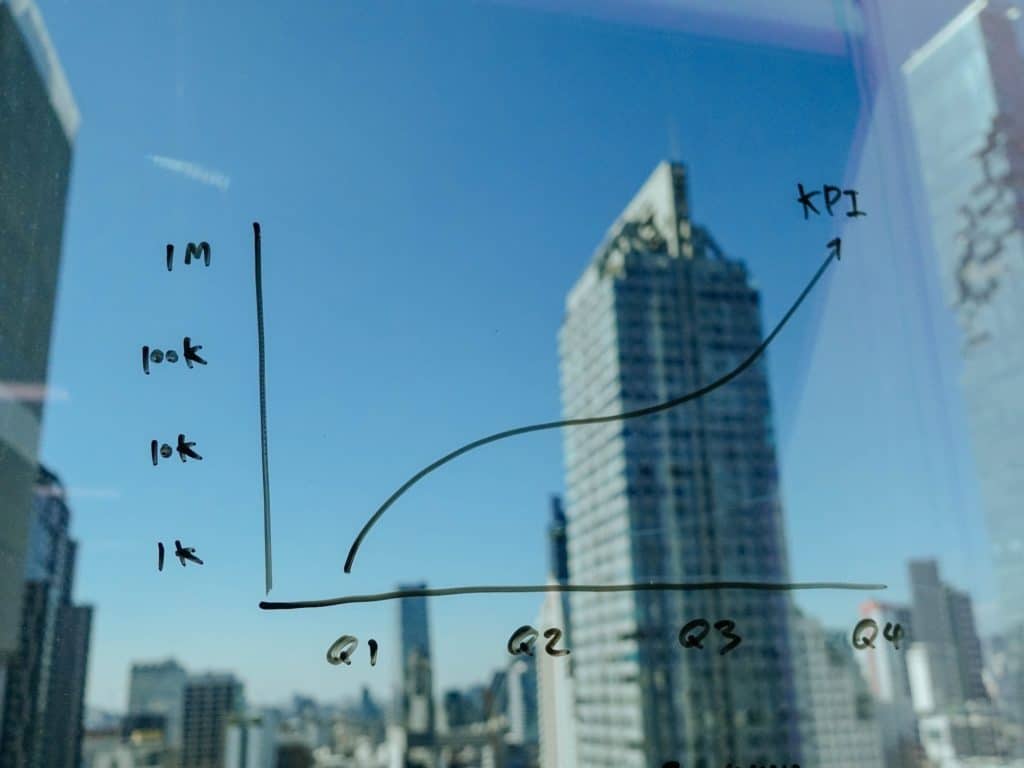

Finance leaders operate under a continuous imperative to monitor the financial health of their enterprise, and to identify areas in which they can realize cost savings and efficiency gains across the business. Finance and Accounting uses dollar measures to tell the story of a business’ performance. F&A logically is a great place for a firm to develop measures of productivity within the firm. Therefore to a large extent, the search for opportunities to reduce waste and inefficiency naturally should begin within the accounting and finance function itself. This investigation requires accurate reporting and the analysis of key performance indicators (KPIs).

The accounts payable process and the people responsible for managing it represent a key area of opportunity for performance improvement and cost optimization. Keeping a close eye on what the organization owes to its suppliers, vendors and creditors is important to measure the company’s financial performance. But measuring the performance of the finance teams processing effort and mistakes helps to drive down the error rate and costs due to process inefficiencies, as well as optimize cash flow. In order to achieve these aims, it is essential to monitor correct and relevant KPIs and benchmark them to industry standards.

In this article, we’ll look at the best selection of key performance indicators to monitor in order to properly benchmark and optimize your Accounts Payable department.

Why Accounts Payable (AP) Monitoring Is Important

Accounts Payable (AP) is a short-term business liability that describes any amount of money that an organization owes to suppliers or vendors for products or services purchased on credit. Effectively managing the AP process is therefore important at many levels.

Timely and adequate payments are required to make sure that suppliers and vendors retain confidence in the organization as a reliable consumer. Settling debts with creditors within agreed timeframes also ensures that the enterprise receives the vital goods and services it needs to meet its own operational requirements and commitments.

At the same time, Accounts Payable outlays must be monitored to ensure that, at any given time, the organization has sufficient cash reserves to continue running the business and plan for growth.

Since the AP department sits at the junction of many business functions, errors, and process inefficiency in Accounts Payable may have unintended consequences that damages the enterprise as a whole. Keeping track of metrics relevant to AP can therefore enable the organization to identify potential problems early, and take the requisite steps to prevent or resolve them. And metrics of the performance of the AP department itself are no less important. Accounts payable is the area that processes the most transactions in the accounting department. Therefore, AP key performance indicators are critical to track to continuously improve departmental efficiency.

What Are Key Performance Indicators (KPIs)?

KPIs are measurable quantities which are directly related to specific performance goals. Using KPIs, it is possible to measure the efficiency, cost, or outcome of the different parts of various business processes.

In line with business and financial best practices, KPIs should be SMART — which is to say, Specific, Measurable, Achievable, Realistic, and Time-bound.

Why KPIs Are Important for Accounts Payable

It is only by measuring performance that one can attempt to improve it. With accurate KPI measurements and metrics for Accounts Payable, organizations can use the data to address analyze and identify the root causes for a number of the challenges typically associated with the AP process. These challenges include:

- Reducing errors due to manual data entry

- Monitoring the collection of invoices from various channels

- Accurately matching invoice data to purchase orders, contract values, and confirmations for goods or services received

- Reducing the number of invoice exceptions

- Identifying fraudulent transactions

- Increasing efficiency across multiple AP channels

More broadly, measuring KPIs for Accounts Payable can provide valuable information for the development of short- and long-term strategies for where to invest in procurement and payment.

The Best AP Key Performance Indicators to Monitor

1. Cost to Process an Invoice

The cost to process an invoice is an important productivity metric which includes all costs that the AP department incurs when processing payments. As a calculation,

Cost of Processing an Invoice = Total Accounts Payable costs / Total number of invoices

Note that the schedule of costs should include the following:

- Salaries and all related benefits and payroll taxes

- Departmental costs (HR, office supplies, outside vendors such as shipping, postage, etc.)

- Overhead (10% of salaries & benefits at a minimum)

- Training

- Recruitment

- Disbursement (check stock, envelopes, postage, toner, etc)

- IT (Gartner estimates $9,600 per year per employee for PCs and software, internet, etc.)

- Travel

- Temporary employees

- Outside vendors

- Software (allocation of the accounting software or any other software used in the AP process, document management, etc.)

- Offsite storage for paper or scanned documents

Other overlooked but also relevant or related costs may include the cost of:

- Mailroom clerk efforts processing mailed paper invoices

- Time in meeting (or corresponding) with Procurement Buyers and/or Suppliers to resolve invoice issues

- Accounting team time correcting and reclassifying incorrect general ledger coding of invoices, and/or researching compiling AP accrual data

- Treasury or finance resource time processing checks, wires or ACH

2. Turn Around Time (TAT) to Process an Invoice

The AP turnaround time or TAT for processing an invoice gives the Accounts Payable department valuable insights into its performance in the payment of invoices, and the timeliness and productivity of its employees. This KPI can also assist the organization in maintaining vendor relationships and establishing the availability of early payment discounts.

To calculate this KPI value: Turnaround Time = End Time (Invoice Paid) – Start Time (Invoice Receipt)

TAT usually measures from the transaction processing cycle, that is the time from the beginning to the end of a performed process, for example from invoice receipt to invoice payment. The average for your firm can then be compared to the average of other similar AP departments to benchmark performance. However, to be more precise and focus on process improvement, one should measure the periods within the control of the party who is being measured, so perhaps measuring the time from when an invoice is received until it is sent out for approval or issue resolution.

3. Number of Invoices an FTE Can Process in a Month

The number of invoices processed per month by each member of the AP department may be quite revealing assuming all staff are fully dedicated to AP processing. If processing is assigned by vendor, measurement of this KPI may give financial controllers an indication of which group of vendor invoices are causing the most significant issues for AP staff. Alternatively, it may indicate instances where training and guidance may be necessary to improve staff performance.

The average KPI for the department may be calculated as follows: Number of Invoices Processed Per Month by Each AP Staff = Number of invoices processed / Number of AP staff who perform the accounts payable (AP) process. This figure can then be compared to industry average performance.

4. Percentage of Discounts Taken

Capturing supplier discounts can yield significant benefits to the organization, in terms of cash savings and business credit. Even companies that don’t have a procurement department negotiating discounts can benefit from the availability of supplier discounts. Closely related to this KPI is the percentage of invoices paid to terms – a figure that provides a measure of whether the business is meeting supplier obligations, and paying quickly enough to be able to take advantage of discounts offered by suppliers.

Percentage of Discounts Taken = (Number of invoice line items that are paid within the discount period / Number of invoice line items received that offer a discount) * 100

Note that for each of the above metrics, if the data cannot be obtained from your accounting system your organization may need to ask employees to keep a log.

Targets for Accounts Payable KPI Benchmarking

Once you have measured your AP Department’s KPI’s described in the previous section the next step would be to compare your department’s performance against industry benchmarks. Generally speaking, the larger the number of invoices, the more productive the AP department – and therefore the lower cost per invoice. However, any company of any size should be able to achieve the following AP benchmark performance levels:

- Less than $5 per invoice (divide the total costs by the average number of invoices)

- More than 1,000 invoices per FTE per month

- TAT of less than 3 business days

- Over 90% of discounts offered being taken

Conclusion

Automation of the AP process or outsourcing Accounts Payable to a full-service accounting company can assist in meeting these objectives. For example, reducing the amount of manual labor required to input the invoice data and route the invoices to obtain the appropriate approvals can save time and increase accuracy. Accounts Payable outsourcing companies usually process invoices more quickly, supporting more timely and useful business information on liabilities, and the ability to take advantage of discounts.

At IQ BackOffice, AP Outsourcing means that invoices received are digitized and made available for online access for you, generally within 24 hours. We also process invoices with 99.97% rates of accuracy, eliminating duplicates, reducing errors and unnecessary reconciliations. Our world-class technology provides our clients with complete transparency and easy to use inquiry tools with drill-down capability so they can readily access the specific information they seek. Clients can easily see the status of any specific vendor invoice with complete audit trail of the processing history and can download the invoice information in whichever format (excel or pdf) they need. We also track processing performance metrics, highlighting root cause of processing inefficiencies. We detail our team’s performance and highlight the bottlenecks to our performance.

For example, Vendor ScoreCards reveal the root causes of challenges such as not putting PO on the invoices and our Inbox Approval reporting reveals where there are aged invoice backlogs.

Here at IQ BackOffice, we provide financial business process outsourcing for large and mid-sized enterprises. We serve a range of diverse industries, including manufacturing and distribution, healthcare and dental, restaurant and hospitality, energy, retail, and technology. Our solutions enable companies around the globe to automate and streamline the complex financial processes they manage.

IQ BackOffice reengineers financial processes to take advantage of best practices and leverage state-of-the-art automation. This allows us to remove manual or inefficient steps, delivering improved controls and up to 70% cost savings for our clients.

To find out more about how IQ BackOffice can reduce costs, track critical KPIs, and streamline your Accounts Payable function, get in touch with us.