Leveraging Outsourced Accounting Services for Business Growth

Leveraging outsourced accounting services is not merely a step in the right direction; it’s a dynamic strategy that propels businesses into a future of boundless possibilities.

Our solutions enable companies around the globe to automate, reengineer and streamline the complex financial processes they manage. Whether it is Accounts Payable, Accounts Receivable, Payroll or other processes, 99.97% quality and up to 70% cost savings is standard. See how IQ BackOffice can improve your business.

IQ BackOffice works with leading global companies which include the world’s largest steel manufacturer, the largest technology and entertainment conglomerate, large retailers and restaurant chains across thousands of stores and e-commerce sites. Other major clients include distribution, energy, healthcare, real estate, and financial services companies.

Our proprietary platform leverages our clients’ existing infrastructure to deliver significant process improvements and faster access to better quality information. Business Process Outsourcing with IQ BackOffice delivers lower costs, better decision-making and stronger financial controls for our clients.

It All Starts With a Leading-Edge Platform

IQ’s proprietary Archimedes platform automates your financial processes, and we help you reengineer those processes to fully take advantage of our technology. The result is a fully optimized process with better performance in all key areas – timeliness, quality, cost and service levels. In contrast, most automation solutions in the marketplace rarely reduce effort and therefore have a negative ROI.

For example, with our innovative IQR technologies, we can process most transactions without human intervention with almost 100% quality. Transactions get processed almost immediately upon receipt at high quality and low cost.

Bullet-Proof Your Company from External Events

IQ’s solution is in the cloud and highly automated, with built-in redundancy of technology, processes and people. During the Covid-19 pandemic, IQ not only continued to serve our clients without a hiccup, but also continued to grow as clients realized the value of our virtual solutions in uncertain times.

Reengineered, best practice processes, automation, transparency and control

Whether you need to upgrade from a platform that worked for your company when it was smaller or you are just starting to digitize the AP process, IQ can help you quickly attain a best practice AP process using the latest technology.

When one of our clients was purchased by a global clothing wholesaler and retailer, we implemented our AP solution alongside their SAP environment, digitizing all of their paper, automating coding and workflows, controlling their inventory, processing every transaction within 24 hours of receipt and cutting costs by 54%.

Comprehensive Billing, Cash Application and Collections Management

Working capital is the lifeblood of a company, but it’s still largely tracked via hand-processed billing, cash application and collections management. IQ BackOffice is ready to move you forward with web-based workflows and automated processing that can cut your costs by up to 70% while providing real-time insight into your accounts receivable and cash flow.

Our client, one of the largest restaurant chains in the USA with over 220 locations, was struggling with the Accounts Receivable of third party delivery services such as Doordash and UberEats. IQ developed a process to effectively reconcile and collect all of the monies due to our client, ensuring that they were being charged correctly, received all of their credits and properly recorded income and expenses.

Increase your savings and control

Companies outsource payroll more than any other function, but many never see the results they expect. At IQ BackOffice, we know that payroll is more than calculating withholdings and cutting checks. We will keep your company current on regulations, efficiently process hires and terminations, generate more accurate data and quickly resolve employee issues.

When a private equity firm purchase a retailer with over 500 locations, we were able to get payroll up and running for over 7,000 employees within a few weeks and ensure accuracy and timeliness from then on.

Automation, reduced Costs, Better Control and More Informed Decisions

IQ BackOffice offers complete accounting services that combine top-to-bottom process reengineering and best practices with web-based workflow systems. We leverage your existing infrastructure to reduce errors and lower costs while improving your controls and deliver real-time insight into your financials at all levels.

When a private equity firm purchased one of the largest chains of hair salons in the USA, we implemented a brand new cloud-based accounting platform, integrated it with a new POS system, developed and implemented all financial processes including Accounts Payable, Payroll, General Accounting, Fixed Assets, and Taxes and Licensing processes within a few weeks, delivering close to real-time financials and saving our client 70% of their back office costs.

Leveraging outsourced accounting services is not merely a step in the right direction; it’s a dynamic strategy that propels businesses into a future of boundless possibilities.

The future of accounting outsourcing is poised for creativity and growth. It’s not just about adapting; it’s about thriving in a time of potential.

Outsourced Accounting services present a transformative approach not just to your department’s efficiency but your business as a whole.

As businesses navigate the complexities of payment schedules, adopting advanced Accounts Payable Solutions emerges as a beacon of hope. Automation, efficient workflows, and strategic management practices not only overcome challenges but also pave the way for a more resilient and optimized financial future, fostering stability, growth, and positive partnerships within the business ecosystem.

Understanding the fundamentals of Accounts Payable is paramount for navigating the intricate terrain of corporate finance.

This article aims to provide a comprehensive comparison between accounts payable outsourcing and in-house management, analyzing key factors such as cost, efficiency, expertise, data security, and the availability of accounting talent.

Accounting transactions have six key issues that prevent them from being managed with proper internal controls and management controls.

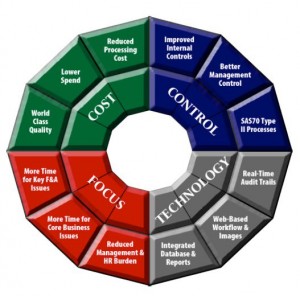

Our approach leads to four main benefits for our clients: Improved controls, Reduced cost, Process Improvements, Improved Focus on Core Business.

Section 404 is listed under Title IV of the Arbanes-Oxley act (Enhanced Financial Disclosures) and pertains to “Management Assessment of Internal Controls”.

We would like to hear from you! If you have a question or comment about our Business Process Outsourcing services, or you’d like an IQ BackOffice representative to contact you, please use the form below. We’ll also send you a link to our Corporate Brochure.

Get notified about new articles, white-papers and case studies.

We would like to hear from you! If you have a question or comment about our services, or you’d like an IQ BackOffice representative to contact you, please use the form below.